US Dollar to Japanese Yen

FX | USDJPY

USD/JPY is one of the most traded currency pairs in the forex market, representing the exchange rate between the United States Dollar (USD) and the Japanese Yen (JPY). As both the US and Japan are major global economies, this pair is highly liquid and closely watched by traders, economists, and policymakers.

Economic Indicators and Central Banks

The performance of USD/JPY is influenced by macroeconomic indicators such as interest rate decisions, inflation data, and GDP growth from both countries. The US Federal Reserve and the Bank of Japan play a crucial role in shaping market sentiment through their monetary policies, making this pair highly sensitive to interest rate differentials.

A Gauge of Risk Sentiment

USD/JPY is often seen as a barometer of global risk appetite. During times of market uncertainty or geopolitical tension, the Yen tends to strengthen due to its safe-haven status. Conversely, when confidence in global growth rises, the USD may gain strength, driving the pair higher. This dynamic makes USD/JPY popular for risk sentiment analysis.

Trading and Strategy

Traders favor USD/JPY for its tight spreads, high liquidity, and strong technical patterns. The pair is active during both the Asian and US trading sessions, providing multiple trading opportunities. Strategies often revolve around economic data releases, interest rate expectations, and technical indicators like support and resistance levels.

Loading...

Statistical info

AI assisted data

AI assisted data

Traditional data

Traditional data

Financial Stats

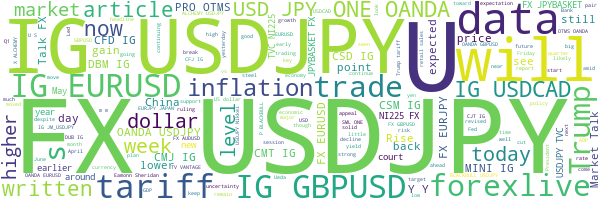

News

Latest News

39 minutes ago

All USDJPY News

nets

Analytical info

AI assisted data

AI assisted data

Traditional data

Traditional data