Silver

COM | SILVER

Silver (XAG/USD) is a precious metal with deep historical significance and modern economic relevance. Prized for its luster and utility, silver serves as both a store of value and a crucial industrial input. Traded globally, its price reflects a dynamic interplay of supply, demand, investor sentiment, and macroeconomic trends.

Dual Role: Industrial and Investment Demand

Silver is unique among precious metals for its dual role. It is heavily used in industries such as electronics, solar energy, and medical technology, giving it strong industrial demand. At the same time, it acts as a hedge against inflation and currency devaluation, making it a popular asset among investors during times of economic uncertainty.

Market Dynamics and Influencing Factors

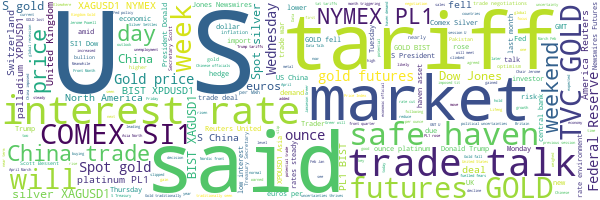

The price of silver is influenced by several factors including global industrial activity, US Dollar strength, interest rates, and geopolitical risk. Unlike gold, silver is more volatile due to its smaller market size and higher industrial correlation, offering traders greater price swings and strategic entry points.

Silver in a Diversified Portfolio

Silver provides a means of portfolio diversification for investors looking to balance risk and return. It often moves in tandem with gold but can offer higher upside during bull markets. As green energy and technology sectors expand, silver’s long-term outlook remains strong due to rising industrial applications alongside enduring investment demand.

Loading...

Statistical info

AI assisted data

AI assisted data

Traditional data

Traditional data

Financial Stats

News

Latest News

Easing US-China trade tensions send gold lower as safe-haven demand weakens

The news highlights a negative sentiment due to the decline in gold prices, which is attributed to weakening safe-haven demand and trade tensions.

May 14, 2025

All SILVER News

nets

Analytical info

AI assisted data

AI assisted data

Traditional data

Traditional data